The cost of health care and health insurance continue to rise, but that doesn’t mean insurance coverage for New Mexicans is out of reach.

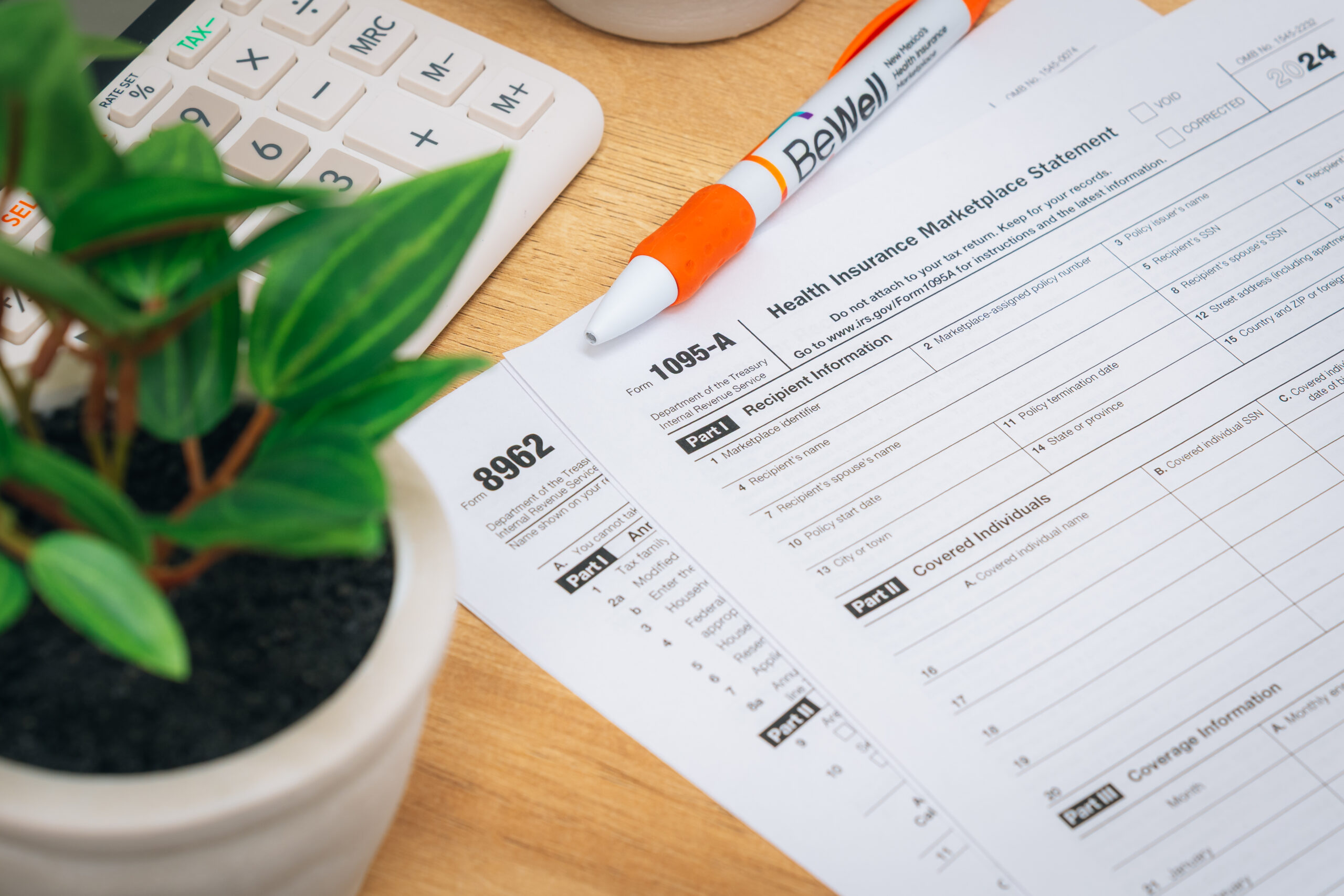

BeWell makes it easy to get affordable health insurance. In fact, BeWell is the only place in New Mexico where people can qualify for subsidies that can significantly reduce the cost of health insurance.

Here are some of the ways BeWell helps make quality health insurance coverage affordable in New Mexico.

Advance premium tax credits

If a person’s income is between ), they may qualify for advance premium tax credits (APTCs) to lower their monthly premium for a health insurance plan through BeWell. The amount of the tax credit is based on the income estimate and household information they put in their BeWell application. Individuals can use our anonymous Shop & Compare Tool to see if they qualify.

Fast facts about premium tax credits in the U.S.:

- 19.7 million: Number of people in the U.S. who qualified for premium tax credits in 2024

- $700: Annual savings by the average enrollee

- 32%: Decrease in average monthly premiums since 2021

Related reading: Explore Metal Tier Plans or Get Financial Assistance

Cost-sharing reductions

Cost-sharing is a discount that lowers how much individuals pay at the doctor’s office, hospital or pharmacy. New Mexicans can get this discount through a turquoise plan or silver-level plan if they qualify based on income.

Native Americans and members of federally recognized tribes might be eligible for other cost-sharing benefits, including zero out-of-pocket costs, regardless of income.

Related reading: BeWell for Native Americans

State subsidies

The State of New Mexico provides additional financial assistance for individuals and families with incomes up to 400% of the FPL. New Mexico recently expanded access to these savings, raising the maximum level from 300% to 400% of the FPL. That means 6,000 more New Mexicans will qualify for the subsidies in 2025.

Families who qualify according to the income guidelines can access a Turquoise plan, which provides the most savings on out-of-pocket costs such as deductibles, copays, and coinsurance.

Related reading: Understanding the Plans Offered on the BeWell Marketplace

Help for affordable health coverage

BeWell offers a range of free help options to answer questions and provide New Mexicans with assistance getting enrolled. Individuals can schedule an appointment with a Certified Assister or enrollment counselor. This help is available at no cost to all New Mexicans.

Our BeWell team members are out in the community throughout the year. At our in-person enrollment events and at Virtual Enrollment Events, individuals can ask questions or enroll in a plan on the spot.