Adulting is hard. Understanding your health insurance plan doesn’t have to be!

When you sign up for insurance, you are entitled to get a Summary of Benefits and Coverage (SBC). The SBC is a document that uses simple terms to explain important details about your insurance.

Every plan you can get through BeWell comes with an SBC. You can use it to learn about differences between plans before you enroll, or use it as a cheat sheet to understand:

- Out-of-pocket costs and deductibles

- Examples of what’s covered and not

- Scenarios for how to use your insurance

There’s a lot of good information packed in an SBC—here’s what an SBC looks like. But they can be a little tricky to read. So, let us show you how to read an example one so you can use these documents to shop for the best plan and understand your benefits.

Need help reading your SBC? Call our Certified Assisters at 833-862-3935. We’ll help you understand your plan SBC at no cost to you!

5 Parts of Your SBC

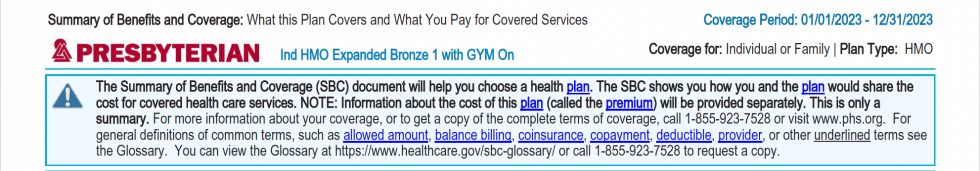

1. Heading

At the very top of your SBC, you’ll see a line that gives you quick information about the:

- Name of your insurance company: Like Blue Cross and Blue Shield of New Mexico or Presbyterian Health Plan.

- Official name of your plan: Such as Turquoise 1 or Gold Standardized Health Plan.

- Coverage period: When your insurance coverage starts and ends.

- Coverage for: Family or Individual, for example.

- Plan type: Such as an HMO or PPO.

The heading looks like this:

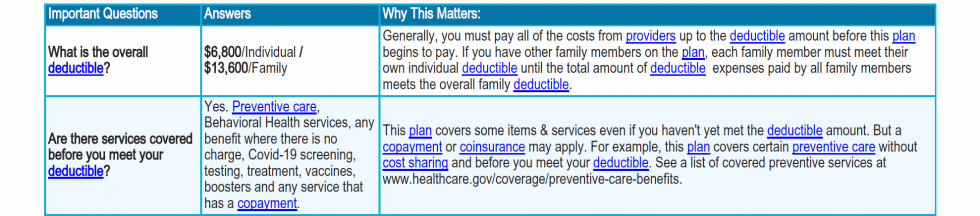

2. Important Questions

This section describes some of the health plan’s costs. For example, how much your deductible and copay are and what you will pay out of pocket for care. This section also explains:

- In-network provider costs: What you’ll pay to see a doctor who contracts with your insurance company.

- Out-of-network provider costs: What you’ll pay to see a doctor who does not contract with your insurance company.

- Referral requirements: Whether you need a written note from your doctor to see a specialist.

The Important Questions section looks like this:

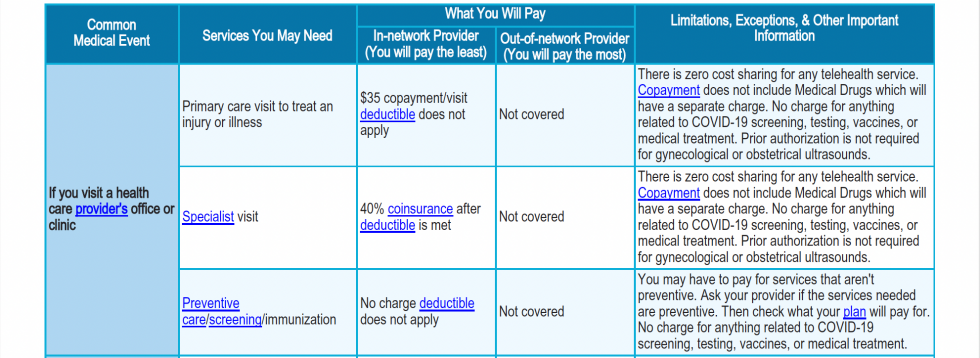

3. Common Medical Events

This section goes over what you can expect to pay under your plan for some common medical needs and events, such as doctor’s office visits, tests, pregnancy or hospital stays. This section lists copays and coinsurance, for common events as well as limitations and exceptions to the rules, if any.

The Common Medical Events section looks like this:

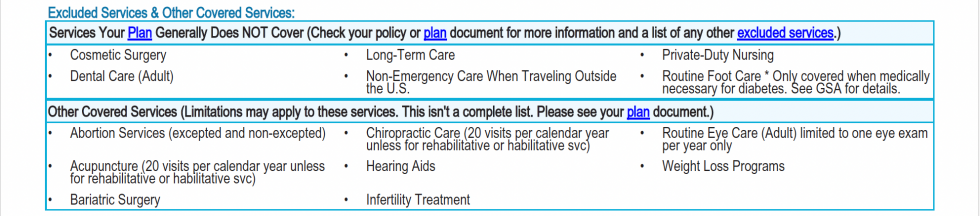

4. Excluded Services & Other Covered Services

This section outlines some of the care and services that are not covered by your plan. Some of the exclusions you might see, depending on the plan you choose, include:

- Acupuncture

- Adult dental and vision care

- Cosmetic surgery

- Long-term care

- Private-duty nursing

This section also explains some benefits that may be covered in your plan but are not very common, such as:

- Acupuncture for rehabilitation

- Bariatric surgery

- Chiropractic care

- Hearing aids

- Weight loss programs

The Excluded Services & Other Covered Services section looks like this:

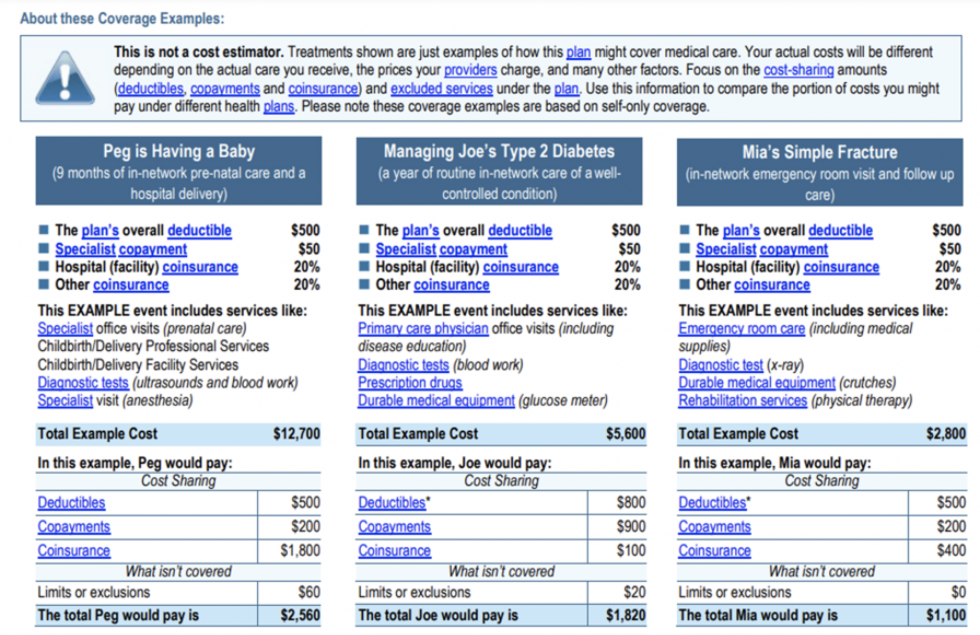

5. Coverage Examples

This section discusses how your plan would cover example situations, such as pregnancy or type 2 diabetes. You can use these examples to compare plans and estimate what you might pay in certain situations. But your actual costs may vary depending on your individual health needs.

The Coverage Examples section looks like this:

Feeling Confused?

That’s OK! There is a LOT of information on an SBC. If you aren’t sure what some of the words mean, browse our ABCs of Health Insurance Shopping to get quick definitions.

Still need help? We’re here for you! Call 833-862-3935 to talk with a BeWell Certified Assister at no cost to you.