To access your tax information for filing 2025 taxes, you will need to log in to your account in our previous system. Visit our Manage Your 2025 Account page for login and account management.

If you have a health insurance plan through BeWell at any point during the year, you will need to “reconcile” your Premium Tax Credits (PTC) when you file your taxes. To do this, you will need Form 1095-A, which will be sent to you by BeWell in January. You can also find this form in your BeWell portal. Customers who had a plan in 2025 will access their 1095-A through the old portal.

You’ll use the information from Form 1095-A to fill out Form 8962 – Premium Tax Credit. This is how you will find out if there’s any difference between the amount of tax credit you used and the amount you qualify for. Any difference between those two numbers may mean you will get a refund or owe money when you file your taxes. Get more information on Form 1095-A and Form 8962.

You will also need to know your Second Lowest Cost Silver Plan (SLCSP) premium. This is the second-lowest priced BeWell health insurance plan in the Silver category that applies to you. You will need this number to figure out the final premium tax credit your tax household qualifies for. Use our SLCSP calculator below to find this number.

BeWell will also send Form 1095-A to the Internal Revenue Service (IRS) to report your health insurance information for the current tax year.

The IRS has developed helpful information on how the Affordable Care Act (ACA) may impact customers’ federal tax return. Visit the IRS website for a list of questions, answers and other resources. You can call the IRS at 800-829-1040 or TTY 800-829-4059.

Second Lowest Cost Silver Plan Calculator

The Second Lowest Cost Silver Plan (SLCSP) is the second lowest priced BeWell health insurance plan in the Silver category that applies to you. You need to know your SLCSP premium to figure out the final premium tax credit your tax household qualifies for.

Part III, column B of your 1095-A, titled “Monthly second lowest cost silver plan (SLCSP) premium,” should show figures for each month any household member was enrolled in a health plan through BeWell. In some cases, the second lowest cost Silver plan (SLCSP) amount may not be included on your Form 1095-A. In this case, use the calculator below to find the premium for your SLCSP.

SLCSP

Calculator

How to Use the Calculator

Step 1: Enter the zip code for your primary residence.

Note: If you moved during the year, you may need to use different ZIP codes for different months. Use the ZIP code of your residential address, not your mailing address, if they are different.

Step 2: Enter the year and month your health insurance plan started.

Note: If you were enrolled in more than one health plan during the year, you will need to select the Enrollment Date based on the time your enrollment started in each plan.

Step 3: Select “Add Member” and enter the first household member’s date of birth. Select “Add Member” until all household members who had coverage in your household have been added.

Note: If you have more than one tax household on your account, you will need to do a separate calculation for each tax household. If you enter a household member by mistake, select “Remove” below their date of birth.

Step 4: Select “Calculate Total.” This is the total SLCSP amount that should be used for each month that you and your household were enrolled in the health plan with the Enrollment Date you entered in Step 2.

Note: If you change the data you entered at the top of the calculator, be sure to select “Calculate Total” again to adjust the total based on the new data.

Additional Notes: Some rates in this online calculator may not include premiums for pediatric dental benefits. You may contact us at 833-862-3935 to verify the SLCSP amounts if you have a child under 19 years old on your policy.

How to Change APTC

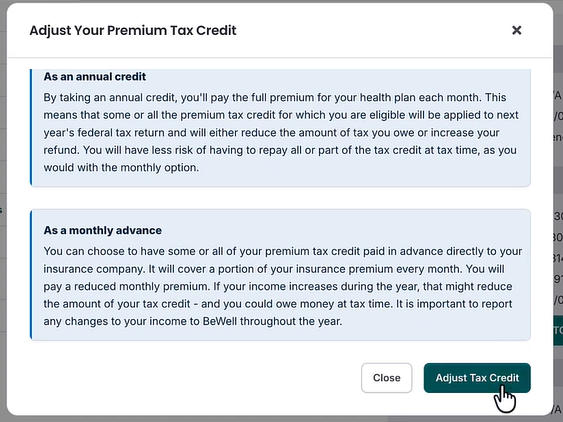

If you do not use your Premium Tax Credits (APTC) during the year, you can claim it all at once when you file your taxes. You will need to reconcile your taxes on your federal income tax return to get this refund.

For example, this may apply to you if you choose to pay your premium in full instead of using APTC each month.

If you decide later you want to take a portion of your Premium Tax Credits (PTC) in advance, follow these steps in your BeWell account.

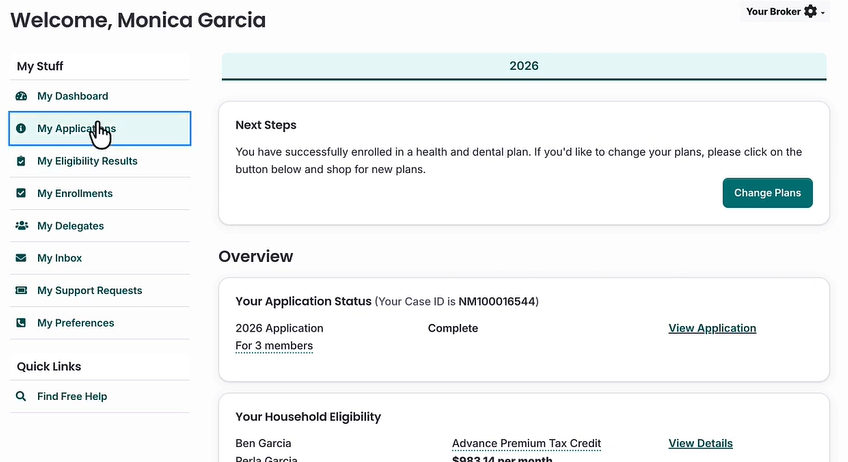

- Log in to your BeWell account.

- Navigate to ‘My Applications’ in your Account Dashboard.

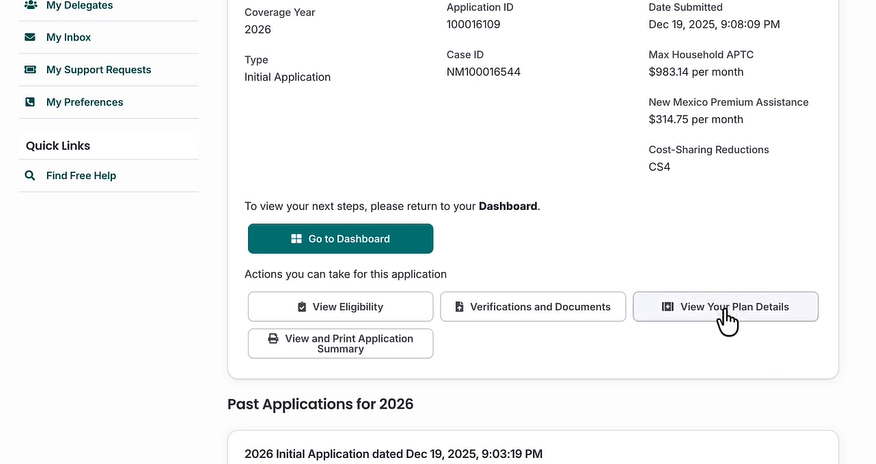

- Click “View Your Plan Details”.

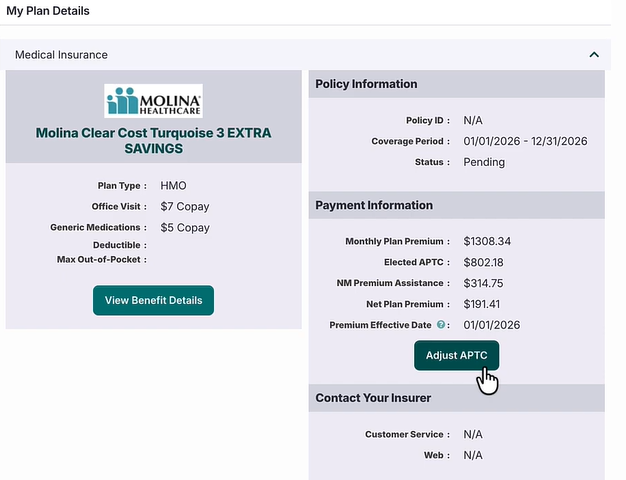

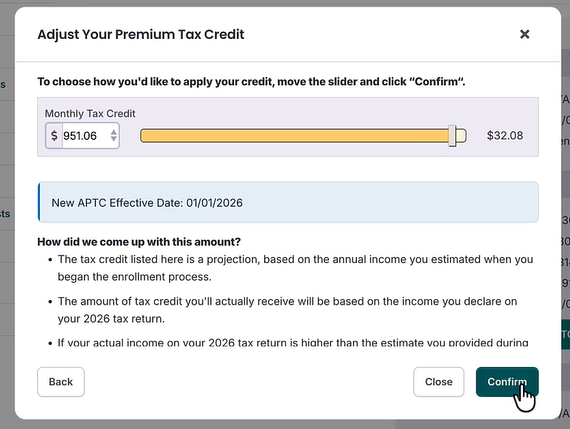

- Click “Adjust APTC”.

- Click “Adjust Tax Credit”.

- Use the slider to adjust the amount of tax credits you wish to apply to your monthly health insurance premium.

- Click “Confirm”.

If You Got Multiple Form 1095-As

If you received multiple Form 1095-As due to having multiple members of your tax household on the same policy or because your household members were enrolled in multiple plans, be sure to calculate the SLCSP based on the household members’ information listed on each Form 1095-A. You may still end up adding these amounts together when filling out Form 8962.

For example: If you have a household of four, and the parents choose not to enroll in coverage, the household will receive two Form 1095-As (one for each child). Use the calculator above for Child 1 to get a SLCSP for that child’s Form 1095-A, then use the calculator for Child 2 to get a SLCSP for that child’s Form 1095-A.

Quick Find

Topics

(833-862-3935), TTY: 711

Monday – Saturday:

8:00 a.m. – 5:00 p.m.

Where Do I Start?

Browse and Compare

Plans

Before you apply for coverage, you can see the health and/or dental insurance plans available. Determine whether you need coverage for 2025 or 2026.

Let Us Do the Work for You

Let us do the work for you! Certified assisters can help you understand your options and enroll in a health insurance plan. They will not push you towards a specific plan or carrier.

Get Answers to Your Questions

We recommend you get free help from our certified assisters, but if you want to do it on your own we have step-by-step instructions and videos to guide you through the application and enrollment portal.

Submit Your Application

When you’re ready to enroll, you can apply online in about an hour. You can also save your application and come back to it, so you can go at your own pace. Create your BeWell log in to get started.