Gold, Silver, Bronze, Turquoise and Clear Cost Plans

There is no one-size-fits all plan when it comes to health insurance. That’s why health plans are grouped into levels on the Marketplace, so you can choose a plan that meets your health care needs and your budget.

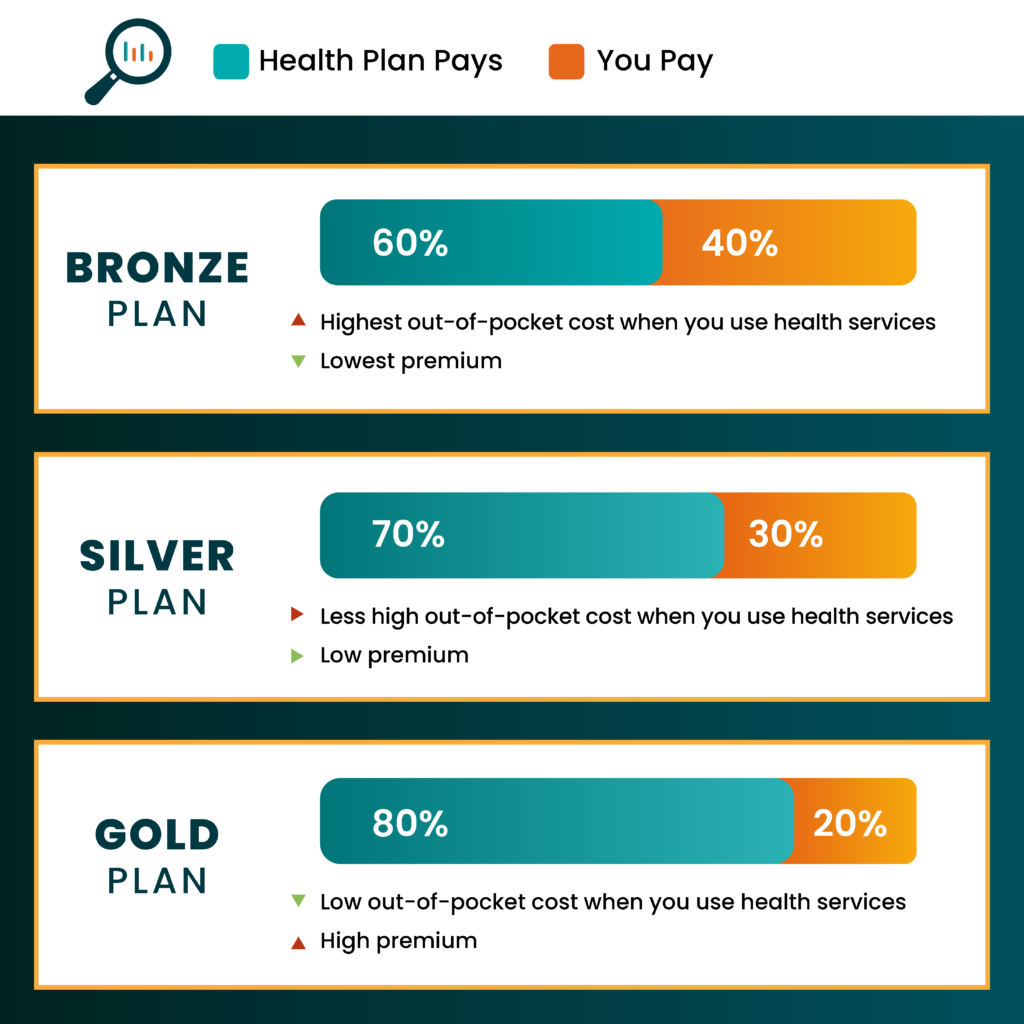

There are three levels of plans offered on the BeWell Marketplace: Gold, Silver and Bronze.

The Marketplace also includes Turquoise Plans and Clear Cost Plans for extra savings and standardized options that are available in gold and silver levels.

Gold Level plans have the highest monthly premium and cover the most out-of-pocket costs. You will pay more each month with a Gold plan, but you will pay less when you need to use your coverage for doctor’s appointments, prescriptions, hospital stays, etc.

Gold plans cover about 80 percent of costs, while you pay 20 percent.

Silver Level plans are a good middle ground. They have lower monthly premiums than Gold plans, but they cover fewer out-of-pocket costs.

Silver plans cover 70 percent of costs, while you pay 30 percent.

Bronze Level plans have the lowest monthly premium and the highest out-of-pocket costs when you use health services. You will pay less each month, but you will pay more when you use the plan for services like doctor’s appointments, prescriptions or hospital stays.

Bronze plans cover 60 percent of costs, while you pay 40%.

While you might think of gold as “better” than bronze, one plan on the Marketplace is not better than any other. The best plan is the one that fits your individual needs and budget.

What Are Turquoise Plans?

If you are eligible for them, Turquoise plans offer the most savings on out-of-pocket costs, including deductibles, copays and coinsurance. If you have an income level that is between 100% and 300% of the Federal Poverty Level (FPL), you will qualify for a Turquoise Plan.

Turquoise Plans are available in Gold and Silver levels.

| Family Size | You may qualify for Premium Tax Credits and New Mexico Premium Assistance, and Turquoise Plans if your annual income is less than: | You may qualify for Premium Tax Credits and New Mexico Premium Assistance, if your annual income is less than: | You may still qualify for Premium Tax Credits if your annual income is more than: |

|---|---|---|---|

| 1 | $45,180 | $60,240 | $60,240 |

| 2 | $61,320 | $81,760 | $81,760 |

| 3 | $77,460 | $103,280 | $103,280 |

| 4 | $93,600 | $124,800 | $124,800 |

| 5 | $109,740 | $146,320 | $146,320 |

| 6 | $125,880 | $167,840 | $167,840 |

| 7 | $142,020 | $189,360 | $189,360 |

| 8 | $158,160 | $210,880 | $210,880 |

What Are Clear Cost Plans?

Clear Cost plans are standardized health plans offered by all carriers. They are available in Gold and Silver levels and include the same fixed out-of-pocket costs for primary care visits, generic prescriptions and emergency services. They have no coinsurance and include maximum out-of-pocket limits.

Compare Clear Cost plans at each metal level and find the best plan for you based on:

- Monthly premium

- Benefits offered by the carrier

- Doctor network coverage

Turquoise Clear Cost plans are also available to eligible New Mexicans for extra savings.

The BeWell Health Benefits Committee researches and designs the Clear Cost standardized plan options. View the final standardized health plan requirements.